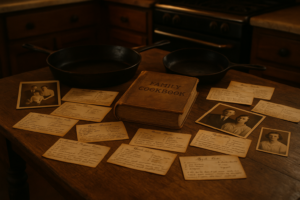

Estate Planning for Heirlooms with Complex Family History

Family heirlooms carry more than financial worth. They paint stories, preserve identities, and often hold emotions that time never dims. Heirlooms with complex family histories require delicate handling. Every hand-off is a chance to honor past generations or resolve old…