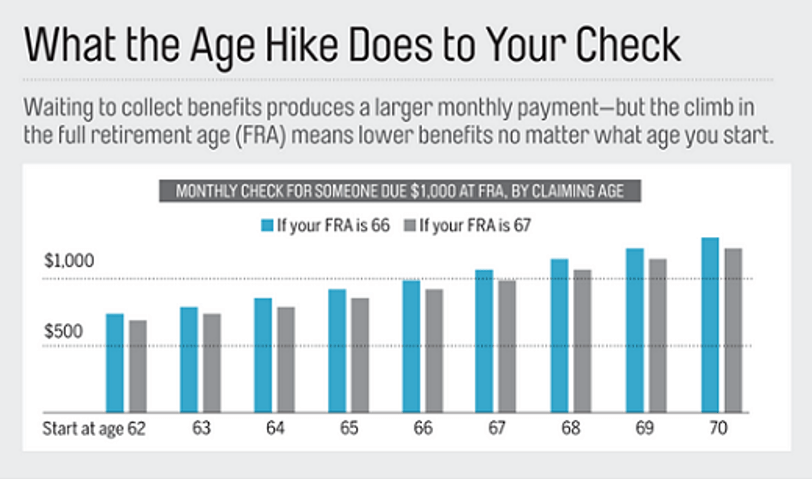

The Social Security Administration has changed the formularies for benefit payouts. Seniors and near seniors need to understand what these changes are in order to optimize their benefit. If you are sixty years of age or more, you are in the forefront of a big change in social security. The full retirement age (FRA), when you can collect your entire earned benefit, has been changed from66 to 67. The implementation of this change will occur in two-month increments over the next six years.

While you are still able to begin your social security benefit payments at 62, delaying it until later years, up until the age of 70, will still ensure you receive a larger check for each month you opt to postpone payouts. However, according to Jim Blankenship, the new reality is that as the FRA goes up, “At every age along the line you are receiving a smaller benefit than you would have before assuming the same work record.” (http://time.com/money/4616738/social-security-benefits-new-retirement-math/)

As these changes are implemented over the course of six years many seniors and near seniors do not understand the implications it has on their benefit total. How can you maximize your social security financial payments in light of these new changes?

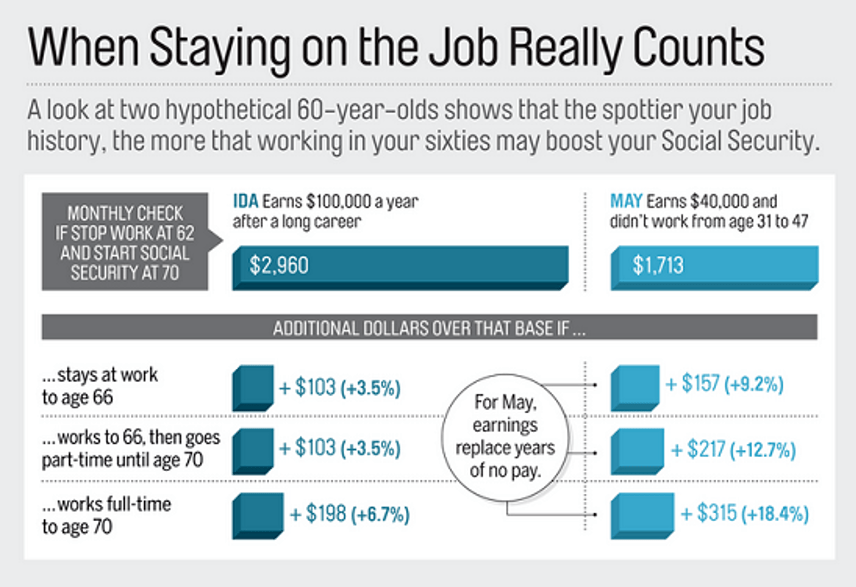

Notes: Assumes part-time earnings are $25,000 a year for Ida and $15,000 for May; full-time pay remains at current levels. Sources: MONEY calculations using Social Security’s detailed calculator.

Should you work longer in your current career or should you change trajectories and work full or part time in a new industry? The answer depends on how long you have been employed and how much you earned during the previous years of your work life. More often seniors who have experienced full employment during their working lives benefit more modestly postponing retirement until the age of 70while those who have been in and out of the work force could benefit far more.

The chart above illustrates how a bigger paycheck may not increase your benefit as much as you anticipated. If you are approaching retirement after a full career you must weigh the pros and cons of retiring at 70 versus 62 years of age which, according to the social security calculator, boosts your benefit a modest 6.7%. To some retirees that percentage increase may be important when factoring in COLA (cost-of-living adjustment) and inflationary tendencies. To others the workload of retirement at 70 might not outweigh the enjoyment of increased leisure time made available to themselves in their earlier retirement years. They may also have a significant amount of funds in a 401(k) or annuity to offset the modest social security increase. However, workers who have been in and out of the work force can increase their benefit as high as 18.4% by working full time until age 70 which in turn positively impacts their retirement benefit. The decision to be made depends on your personal work history and the financial means available to you beyond social security benefits.

While this may be surprising it is not the only unexpected math you may encounter when you are deciding when to claim social security. In order to make the smartest decisions that get you the most money this is what you need to know. Because of the new full retirement age, waiting until 70 to claim your benefit means you will receive a smaller bonus. The fact of the matter is the newly increased FRA is a benefit cut.

Notes: FRA is 66 for people born between 1943 and 1954 and then creeps up in two-month increments, reaching 67 for those born in 1960 or later. Sources: MONEY calculations using Social Security online tools

Why did this occur? When social security began in 1935 the age to collect benefits without a reduction for early retirement was 65. Then a new law enacted in 1983 changed the FRA to 66 for those born between 1943 and 1954 and 67 for those born in or beyond 1960. Since 1935 overall life expectancies continue to increase despite some small, occasional downticks and so without periodic increases in the FRA the Social Security Administration would pay each generation more over time as a result of seniors living longer lives. This would add an unsustainable burden to an already financially challenged social program. See www.slate.com/articles/health_and_science/medical_examiner/2016/12/life_expectancy_is_still_increasing.html for additional information.

These changes in calculations for social security benefits can significantly impact how successfully you can transition into a happy, well-funded retirement. Being proactive about responding to the new full retirement age for social security benefits is crucial to positioning your financial plans and goals to accomplish such a transition. One certainty is that every senior has a different situation based not only on their age but, on their work and financial history.

If you have questions or need guidance in your planning or planning for a loved one, please do not hesitate to contact our St. Charles office.